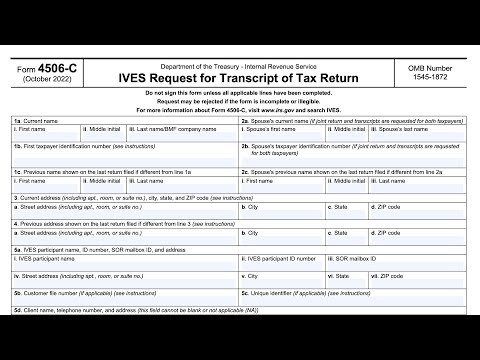

We'll be going over IRS form 4506-c as the Ives request for transcript of tax return see most taxpayers probably won't see this form unless they're requested to complete one for uh from by a mortgage lender for example for purposes of income verification while you're applying for a mortgage so a couple of things here one Ives stands for the income verification express service administered by the IRS the Internal Revenue Service and and basically this is a way that the IRS can facilitate the volume of income verification transactions from when lending institutions while safeguarding taxpayer data so basically the Ives system allows certain companies that are pre-vetted Ives participants to request this data with taxpayer permission from the IRS in a streamlined manner and so this is a requirement for many lending institutions for example Fannie Mae has made this a requirement for loans that they cover so this form replaced IRS form 4506-t in 2025 individual taxpayers could still use IRS form 4506-t however for Lending purposes most institutions have moved on to this so individual taxpayers will primarily see this when they're requesting a mortgage and they're using this to verify their income so we'll walk through this tax form we'll cover a couple of other things that you should probably know so in line one we'll use our hero John Doe enter his first name middle initial and last name here the BMF company name so if you were applying as part of a company this would be basically the the master file whatever the company's name is and the irs's master file system that's what you would enter there instead of a taxpayer name taxpayer ID number can be a social security number as it is here it could be an individual taxpayer...

PDF editing your way

Complete or edit your irs form 4506 c anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export irs form 4506 c printable directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 4506 c as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 4506 c form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare 4506 C Form PDF

About 4506 C Form PDF

The 4506 C Form is a document provided by the Internal Revenue Service (IRS) in the United States. It is used to request a copy of a previously filed tax return or a tax transcript from the IRS. The form allows individuals or businesses to obtain official copies of their tax documents, which can be useful in various situations such as applying for loans, verifying income, or resolving tax-related issues. This form is typically required by individuals or entities who need to provide documented proof of their past tax returns or financial information. It is commonly used by financial institutions, lenders, mortgage companies, employers, government agencies, and other organizations as part of their verification process. For example, banks may request Form 4506 C from loan applicants to validate their income claims. However, it is important to note that there are different variations of the 4506 form, such as 4506 T and 4506 C-EZ, which may be used depending on the specific purpose or situation. It is advised to consult with the requesting party or a tax professional to determine the correct form and procedure required.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 4506 C Form PDF, steer clear of blunders along with furnish it in a timely manner:

How to complete any 4506 C Form PDF online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your 4506 C Form PDF by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 4506 C Form PDF from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

What people say about us

Video instructions and help with filling out and completing 4506 C Form PDF